As Cloud-Native technologies are in mainstream adoption, financial services and core banking products have started adopting them across the spectrum. Fintech companies building core banking products have accelerated the trend and the traditional players have also started their journey with a well-defined roadmap to adopt cloud-native technologies.

Cloud-native architecture is not just limited to building solutions using managed services by hyperscalers (AWS, Azure, and Google Cloud), but also driven using the innovative products by the opensource community. CNCF community has exemplified by their catalog of such services and also fostered the ecosystem of cloud-native technologies. Their view of Cloud-native technologies expressed as:

Cloud-native technologies empower organizations to build and run scalable applications in modern, dynamic environments such as public, private, and hybrid clouds. Containers, service meshes, microservices, immutable infrastructure, and declarative APIs exemplify this approach.

(source: cncf.io)

Core Banking Products & Cloud Native Adoption

Core banking (retail or commercial) products traditionally have been using monolith and heavyweight architecture primarily driven by the legacy behind the same. With the rise of competition and modern architecture practices adopted by new-age players, Core banking products have been revolutionized with the adoption of Cloud-native technologies.

Key observations are:

- While the established players such as Infosys EdgeVerve, Oracle FLEXCUBE, and TCS BaNCS have adopted Cloud architecture, modern age players such as Mambu, ThoughtMachine, and 10X have their foundational architecture built since start using Cloud-native architecture.

- Though there is a tendency to get aligned to big players such as AWS, Azure, or Google Cloud considering their market presence, Hybrid-cloud is the most practical solution considering the on-premises systems because of legacy architecture, regulatory compliance, or security reasons.

- While the below spectrum helps to visualize the early adopters using cloud-native as a foundation since the beginning, traditional players have also accelerated their journey towards the adoption (note that this is the personal observation only):

Foundational Focus Areas with the applicability of Cloud-native Architecture

While analyzing pure native players, it has been observed that the following foundational focus areas in these products when applying cloud-native architecture:

- 12-factor App Principles: Modern architecture following the early cloud-native architecture principles help build a loosely coupled, independent, and microservices-oriented to support easy application upgrades.

- Cloud-enabled Architecture: A common architecture principle across modern architecture players is to build the solution using Cloud-native services and keeping the cloud architecture principles in consideration to ensure high availability, scalability, security, and use the pay-as-you-use model (particularly for SaaS players).

- Data Platform & Real-time Integration: Data platform with support for Event-driven architecture for streaming and real-time data integration is one of the key building blocks in new-age architecture. Data quality and data engineering supporting the data ecosystem is key element as well.

- Scalability, Availability & Resiliency: With the cloud as the underlying foundation, the ability to Scale Up or most importantly Scale Out is the key differentiator.

- Operational Excellence using Cloud: Whether it is a SaaS-based model or flexibility to deploy to the cloud provider of your choice, the key capability is to reduce operational overhead, and enable operational efficiencies when launching a banking solution. A key example is the capability to launch the bank in months or days and support the business in terms of launching new capabilities as demanded.

- Continuous Integration & Continuous Deployment: New players have leveraged continuous delivery practices as the core principles such as Infrastructure-as-a-code (IaaC), GitOps based Continuous Deployment, Configuration-as-a-code, DevOps to DevSecOps, etc.

- Developer Ecosystem with Platform: Recognizing the fact that change is the only constant, the developer ecosystem to extend the banking platform has been a key focus area. Developer Portal for API Management, Custom Component extension using SDK, and Connectors for Integration are a few examples of supporting the developer’s ecosystem.

- Documentation & Transparency: New age players are not restricting themselves in terms of sharing the information publicly in alignment with Opensource principles. While traditional players have been restrictive in terms of sharing their product documentation, new players have enabled the community with easy documentation access and community support.

- Vendor Integration: Recognizing the reality that modern architecture requires specialized vendors or even client-preferred vendors, the new trend is to support Open standards (such as Openbanking) and provide the necessary support (such as SDK, Connectors) to integrate vendors. Vendors’ offering can also be competitive to the features being offered by their core banking product but they are not limiting the framework to provide such support. A few examples of such capabilities are — Payment gateway, KYC and KYB, Regulatory and Compliance, eSignature, ID Verification, etc.

- AI & Machine Learning: AI and machine learning in decision making, analytics and behavioral analysis, trend analysis, etc. for intelligent banking has been another aspect to improve the customer experience as part of core banking solution.

Reference Framework for Building Core Banking Solutions

While core banking is such a comprehensive field, modern vendors recognize the importance of the focus area, and accordingly, they built the ecosystem. For example, Mambu and ThoughtMachine’s primary focus area is retail banking while they are open to supporting commercial and wholesale banking operations.

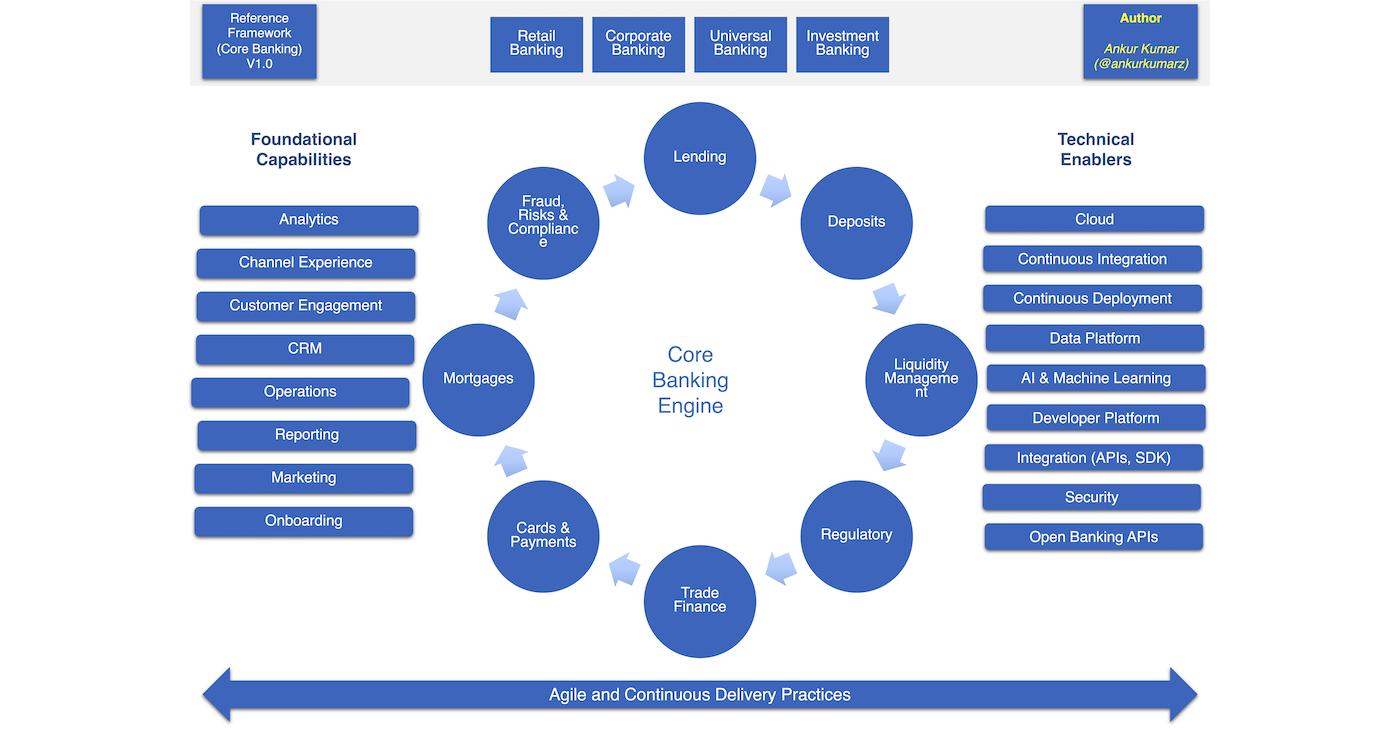

In general, functional capabilities can be incrementally built using cloud-native architecture by designing the open systems, which are ready for third-party integrations and transparent in terms of connectors & integration patterns. Below is a reference framework encompassing key foundational capabilities, technical enablers, core banking capabilities with an agile and continuous delivery mindset applied to achieve the same.

Reference Technology Architecture for Core Banking

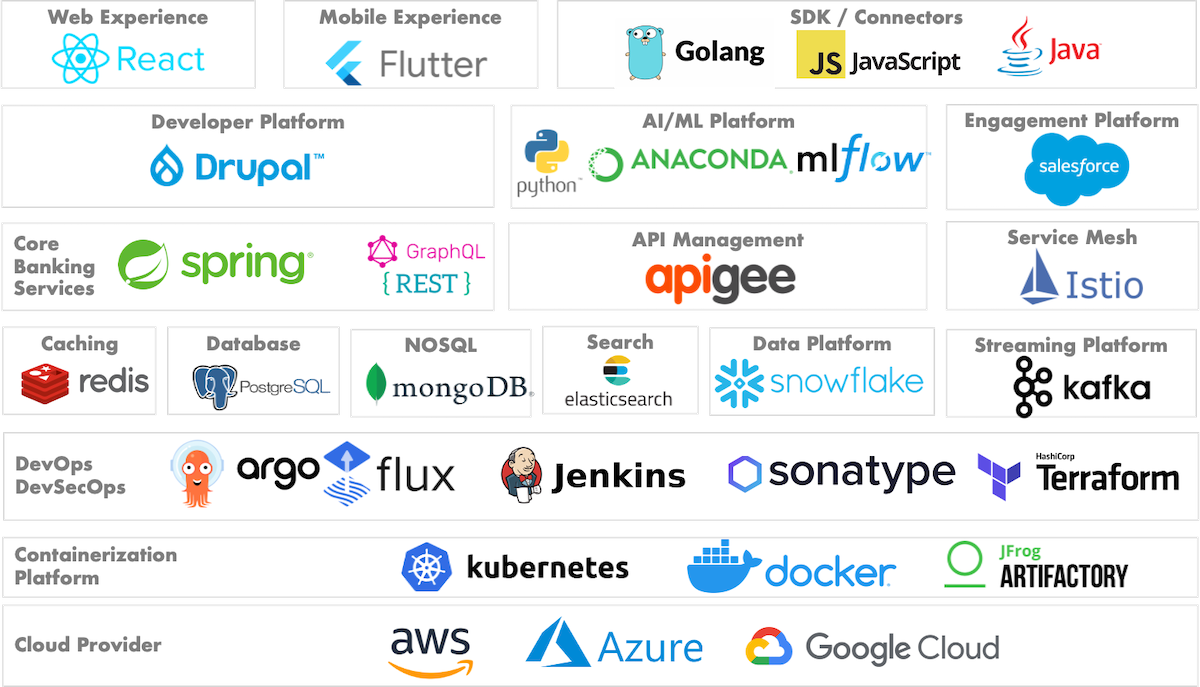

While it is contextual to establish any product’s architecture, below is an effort to depict a reference architecture using the most frequently used vendors across different capabilities. Vendor and technology selection is a complex process and often driven by many factors contextual to the product company. While the technologies represented below are indicative only as there is always an alternative option, the focus is to highlight the technical enablers required to build the modern core banking solution.

To conclude, usage of cloud-native architecture in core banking will continue to evolve with new patterns with a fast-paced technology landscape. We will continue to experience core banking solutions built with nimble, open & transparent, extensible, standards-driven, adaptable, and cloud-native architecture principles in consideration.

Disclaimer:

All data and information provided on this blog are for informational purposes only. This makes no representations as to the accuracy, completeness, correctness, suitability, or validity of any information on this site and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis. This is a personal opinion. The opinions expressed here represent my own and not those of my employer or any other organization.